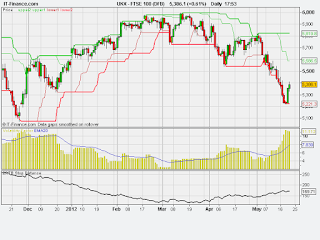

I've shown below the current chart of the FTSE, which has seen a couple of 'up' days to start this week. Does the price action of the last couple of days change anything? To a trend follower, no. Based on this chart, the system parameters used show that the trend is down, and the price action contained within the trend is deemed to be 'noise'. Indeed, the parameters used in the system indicate there can be further upside of 200 points or so before the trend is called into question. However, the last couple of days is where the psychological side comes into play. You would need to remain faithful to the system, and not 'second guess' what it is telling you. How would you feel if you exited a short position on this right now, only for it to fall say 1,000 points over the next few weeks? Remember the words of Old Partridge in Reminiscences of a Stock Operator - don't lose your position.

Remember that trend followers never go 'all in' on a position. There is no such thing as a 'cannot lose' bet. Appropriate risk management will keep us in the game, even if we are proven wrong on this particular trade. All we can do is follow the signals, control our risk, and wait for an exit signal (whenever or wherever that may be).

Trend following is based upon identifying a trend, and following it. We never predict when a trend will end, as that may severely curtail our profits, should a significant trend take hold. So, in the current market state, traders who follow such a system would be short, and will remain so until an exit signal is given.

No comments:

Post a Comment