Anyone who thinks that trend following doesn't work obviously hasn't studied the many charts I've posted on here recently. Trends may only last a matter of weeks, but over time the results add up. Don't take my word for it - there have been too many traders who have used trend following principles to make significant money in the markets.

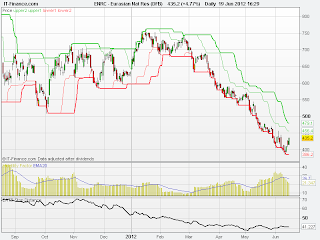

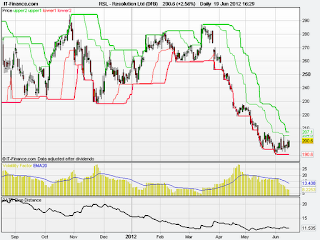

The only problem is that we never know which signal will generate the big wins. Look at the two charts below, that show beautiful recent downtrends, having repeatedly had failed breakouts prior to that.

A trend follower must be completely at ease in being able to follow the signals unemotionally, in whatever direction the charts are telling you. You must also have the ability to switch from looking for longs to short, or vice versa, in a relatively short period of time - again, being led by what the charts are showing. Strict risk management will help with this, as you must never 'bet the farm' on any individual trade - to coin a famous term from Market Wizard Larry Hite, you must have an 'emotional indifference' to each position you take, which is impossible if you are trading too large a position relative to your trading equity. Had you have done so on the failed breakouts shown on the charts below, you would have suffered a serious erosion in your capital, or have even blown up your account, meaning that you wouldn't have been around to take advantage of the nice downtrends that finally developed over the last few weeks.

No comments:

Post a Comment