Although I concentrate on trading stocks, most trend followers tend to concentrate on other instruments, such as commodities, forex, indices, interest rates etc. To a degree, all markets are inter-related in some way or another, so I do look at these charts periodically, and as you would expect, there are trends popping up all the time.

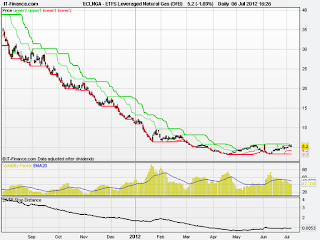

I posted a chart here showing the recent downtrend in crude oil, which has now given an exit signal. I've now come across another great trend in Natural Gas, and I show a chart of the ETF below. Natural Gas is something I have never traded. Despite giving one or two exit signals (that quickly reversed) this shows a fantastic downtrend that has run from early August 2011 to the beginning of May! It is currently trying to bottom out and consolidate at these levels before trying to start a new uptrend, which has now had one or two false starts, and gave another buy signal yesterday before falling back retreating.

If you happen to trade such a basket of instruments, then it is important to act on ALL the signals that your system generates. Okay, you may have to suffer failed signals like those in the last couple of months, but then again, if you started being selective and gave the signal given in August 2011 a miss, you would have missed out on a very profitable trade.

No comments:

Post a Comment