One of the things that gives me pleasure is how many of the people I have given training to are very receptive to the methodology and ideas I use and teach. In addition, a lot of them also are quickly able to have a good idea of what constitutes a good looking set up, as well as which ones to avoid.

Almost to a person, they can see how trading can be simplified down to its bare essentials, without having a battery of indicators to look at, or economic reports or company earnings reports to wade through. As Ed Seykota would say, it's an 'A-ha!' moment.

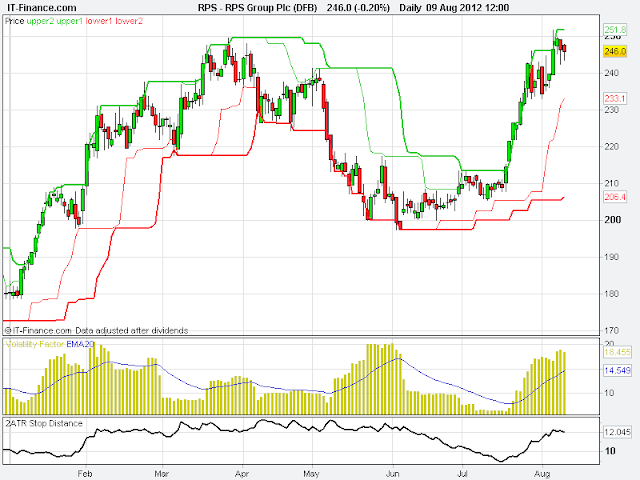

During the webinar the other night I was talking to someone who acquired my e-book in mid July. He mentioned that the first trade he put on after that was a long position in UK stock RPS Group (chart below). As you can see, this is a great example of what I look for in a set up.

Some may say that's beginners luck, but I prefer to say its because he has been open to the idea of focusing on what generates profits in the markets (price movement in the direction you identified) and has grapsed the concept of risk control. As for the psychological aspect, that will be earned over time as the ideas become second nature, as well as dealing with the issues 'when the trend bends at the end'. Having a mentor to discuss these issues when things are not going as intended is also invaluable - that's what I'm here for.

I would also point out that the majority of people I have taught and correspond with are already in full time employment, and that this method of trading allows them to participate fully in the markets and gives them the potential to generate decent profits, without taking up a lot of time.

If you are interested in learning more, please check out my services page. Testimonials for the e-book and training services are here.

No comments:

Post a Comment