This week has been rough for those trading on the long side. Indices have shown weakness - some more than others. This is the phase where there is the inevitable 'giving back of profits' that all trend followers endure, when an existing trend shows signs of reversing.

Again, I am very lightly invested at the moment, as existing long positions wind themselves down - barring any significant gaps through stop levels, those profits will be banked in the coming days, should they and the general markets continue to move south.

Below is a chart for the German DAX, which has now given a short signal

The FTSE is close to giving the same signal.

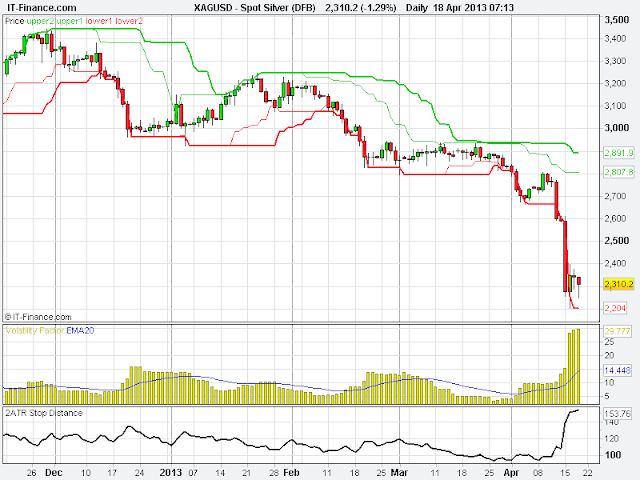

There has been lots of comment about the sharp fall in gold, so I am showing the chart for silver instead. However it is showing the same characteristics of a very forceful downtrend. As has been mentioned on several recent posts, the fall in precious metals has coincided with a karge number of downtrends in mining and resource stocks, which have generated nice downtrends - in spite of the indices generally trending upwards. this is one of the reasons why, in my e-book, I recommend having a small proportion of your trades open that you are trading in the opposite direction.

No comments:

Post a Comment